Canara Bank Fixed Deposit

There is no doubt that Fixed Deposit or FD’s are great instruments of investment where we can invest our money. This instrument of investment is famous for a long period of time. There are various types of FD that can have tenure of 7 days to 10 years. If you are planning to save tax you can use the tax saver FD option. But if you don’t want to invest in FD and still save tax then you can opt for tax saving mutual funds. But the catch in this is the money will be locked for a long period of time. In this article of mine, I will be telling you the steps which you need to follow to close fixed deposit in Canara Bank.

I will tell you everything you need to know about the premature closure or withdrawal of your fixed deposit in Canara Bank. There are some consequences which you will have to face when you close fixed deposit in Canara Bank. You even have to pay some amount as the penalty for your premature close of FD. I will try to elaborate on the things as much as possible in this article. It is well known that if you open the fixed deposit then your money will be locked for a certain period of time.

Contents

About Canara Bank

- CANARA BANK FD calculator online - Calculate CANARA BANK FD Interest rate using CANARA BANK Fixed Deposit calculator 2021. Check CANARA BANK FD rate of interest and calculate FD final amount via CANARA BANK FD Calculator on The Economic Times.

- Latest Updated Deposit rates News: Bank Offers 5.40% p.a. For Canara Tax Saver Deposit scheme (General Public). Maximum deposit acceptable is Rs 1.50 Lakh. You Can Invest As low as Rs.1000/- Per Month Minimum 15 days (7-14 days – Only for single deposit of Rs.5 lakh and above), Maximum 120 months.

| Head Office Address | 112 J C Road, Town Hall Junction, Bengaluru, Karnataka |

| Trade As | BSE: 532483 NSE: CANBK |

| Type of Bank | Public Sector Bank |

| Founded | 1906 at Mangalore, Karnataka |

| Products | Investment Banking, Consumer Banking, Commercial Banking, Retail Banking, Private Banking, Asset Management, Pensions, Mortgages, Credit Cards |

| Owner | Government of India |

| Number of Employees | 58,000 (March 2019) |

| Owner of the Bank | Government of India |

| Website | www.canarabank.com |

| Revenue (2019) | ₹54,269 crore |

| Operating Income (2019) | ₹10,461 crore |

| Net Income (2019) | ₹547 crore |

| Total Assets (2019) | ₹7,11,782 crore |

| Customer Care (toll-free) | 1800 425 0018 |

What is a Fixed Deposit?

Fixed Deposit is an investment instrument that is provided by the banks to their account holders. And Canara Bank is one among those banks which offers the service of fixed deposit to the people who have a bank account with them. The actual concept of a fixed deposit is that you will earn more interest rates when we compare that to a savings bank account.

Features of Canara Bank Fixed Deposit:You can open fixed deposit account with minimum of 1,000 Rupees and Maximum Unlimited.Fi.

And in the case of Canara Bank, the Fixed Deposit Interest rates are quite higher when we compare to the interest rates which are offered with the Canara Bank Savings account.

What is the Actual Meaning of Closing a Fixed Deposit?

But if you have some emergency or you need your money back then you can get it back too. There is a provision of getting your money out of the FD before the date of maturity. And that is what actually termed as the closing of fixed deposit. In simple words, this is called as the breaking of FD.

I will be telling you two methods which you can follow to close fixed deposit in Canara Bank and get your money back. The steps which you need to follow are quite simple and I am pretty sure that you won’t be facing any difficulties to do it.

Advantages of Fixed Deposit

There are many advantages of FD let me try to list some of them today so that we can understand the concept of FD in a better way.

- Guaranteed returns.

- Flexibility to choose the maturity date.

- Easy to get a loan against Fixed Deposit.

- We get higher levels of safety and security for our money.

Guaranteed Returns:

The main reason why people go with the fixed deposit is that the returns are guaranteed. It is not like any other investment option like mutual funds etc. which depends upon the market performance. No matter if the market is up or the market is down. You will be getting your return and this is the biggest advantage of the fixed deposits.

Flexibility to Choose the Maturity Date:

These days almost every bank offers an option to open a fixed deposit with them. And we have got the tenure options from 7 days to 10 years. You can choose any time period of the time which means you totally have the option to choose the date when you will be getting your money back with some good interest added to your principal amount.

Easy to get Loan Against FD:

If you have some urgent need for money and you don’t want to close fixed deposit in Canara Bank. Then you have an option to get a loan against your fixed deposit. Not only in Canara Bank but almost all the bank which have an option of FD can offer you loan or overdraft against it. In the case of the Canara Bank, you can get loan up to 90% of the deposited money in this investment instrument.

Higher Levels of Safety and Security:

The safety and security which we get for the money which we have invested in FD are higher when we compare to that of the other investment instruments and this is definitely one of the advantages.

Disadvantages of Fixed Deposit

Just like the advantages we also have the disadvantages which we get with fixed deposits. I have listed out some of the disadvantages below.

- Poor Liquidity.

- Low Returns when Compared to Other Investment Options.

- Penalty on Premature Withdrawal.

Poor Liquidity:

There is no easy access to the funds or money which you invest in the FD. If you want to take out your funds out before the maturity date then you can not do that for free. Hence you need to wait until the FD gets mature no matter how badly you need the money but you can not get it out of this investment instrument.

Low Returns:

There are many other places where you can invest your money and get returns more than that of the fixed deposits. So if we look at this with a perspective of the returns then this is not the best place where we can invest our hard-earned money.

Penalty on Premature Withdrawal:

This is the biggest disadvantage that we have with the fixed deposit. If you want to get your money out before the maturity date then you will have to pay penalty of 1% of your total amount. Along with this, you won’t be getting the interest as well.

These are the various advantages and disadvantages of fixed deposits. What do you think about these? or do you have any others in your mind?

If you have and want to share the same with other then you can do that by commenting below. We have a comment section at the end of this article.

Steps to Close Fixed Deposit in Canara Bank

Canara Bank Deposit Rates

Now we know quite many things about the FD’s so let us now check out the steps which you need to follow to break or close fixed deposit in Canara Bank. You can do this by following two methods and they are as mentioned below.

One of those methods is an online method in which you will have to make use of your internet banking account. And the other one is an offline method in which you will have to personally visit your home branch and write an application letter or fill the premature closure form to close fixed deposit in Canara Bank. I will be telling you the steps that you need to follow in both of these methods.

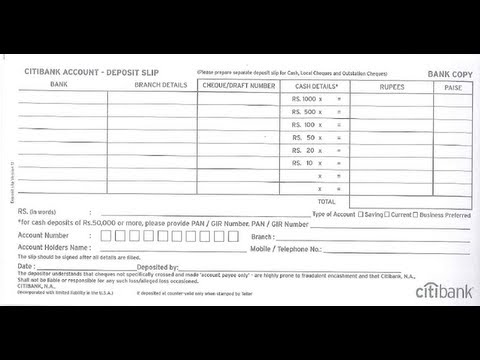

Canara Bank Fixed Deposit Form

- Go to your Canara Bank Home Branch from where you maintain your bank account.

- Tell the bank officials that you want to close your fixed deposit.

- Ask for an FD Closure form. (premature closure form)

- Fill the form with all the required details.

- Make your signature on the form wherever required.

- Submit the duly filled form and your FD will be closed by the bank.

Once your fixed deposit is closed the money will be deposited back to your savings bank account which you have in Canara Bank. If you don’t get the Canara Bank Fixed Deposit Form or Closure form then you will have to write an application letter addressing your branch manager.

If you don’t want to personally go to your home branch then you can close fixed deposit in Canara Bank online with the help of internet banking.

But to do this you will need an active internet banking account. In this case, if you have not yet activated internet banking or net banking for your Canara Bank account. Then you can follow this guide on Bank With Us about the procedure to activate internet banking in Canara Bank.

- Go to the official website of the Canara Bank.

- Click on Net Banking Retail/Corporate.

- Enter your User ID and Password of internet banking.

- Solve the Captcha and click on login.

- Click on Deposits from the top menu in the internet banking interface.

- Click on Deposits and then on Open Fixed Deposit link.

- All the fixed deposits you have in your account will be displayed in front of you.

- Select the Fixed Deposit which you want to close.

- Enter your transaction password.

- And follow the on-screen instructions.

Once you successfully close fixed deposit in Canara Bank, your money will be deposited back to your savings bank account shortly.

Conclusion

So these are the two methods that you can follow to close fixed deposit in Canara Bank. I hope you are clear with all the details and the steps which are mentioned in this guide. If you have any kind of doubts in your mind then you can comment down below. And if you want to get assisted quickly then you can call the customer care of the bank on their toll-free number: 1800 425 0018 and talk to the customer care executive for more details.

Is Canara Bank FD Safe?

Yes, if you are planning to open FD in Canara Bank then you can do that without any fear losing your money, You can trust this bank and this bank is owned by the Government of India.

Can I get Loan Against my FD?

Yes, you can get a loan up to 90% of your FD amount. You can either choose between Overdraft or Loan at less rate of interest.

What is the Minimum Tenure of FD in Canara Bank?

The minimum tenure of fixed deposit in Canara Bank is 7 Days.

What is the Maximum Tenure of Fixed Deposit in Canara Bank?

The maximum tenure or time period for which you can have an FD in the bank is 10 Years.

What are the Documents Require for FD in Canara Bank?

You have to submit address proof document, address proof documents and 2 photographs to open an FD in this bank.

Can I Close Fixed Deposit Before Maturity Date in Canara Bank?

Yes, you can close or break your fixed deposit before it gets matured. But you will have to pay the penalty to the bank.

What is Penalty for Closing Fixed Deposit in Canara Bank?

You have to pay 1% of the total FD amount as a penalty to the bank.

Is there an option of partial withdraw?

Yes, there is an option of partial withdraw of money from your FD account. But I recommend you to contact the bank and get this thing confirmed by the bank officials.

How Will I Get My Money from the Fixed Deposit?

The money from your fixed deposit account will be credited to your Canara Bank savings bank account when it gets matured or closed.

Can I Close Canara Bank Fixed Deposit Online?

Yes, you can close your FD online. But you should have access to your internet banking account to do it.

Can I Close Canara Bank Fixed Deposit Offline?

Yes, you can close your FD offline by visiting your home branch of the bank. Go to your home branch and tell the bank officials that you wish to close your FD.

Can I Deposit More Money?

No, you can not deposit more money into your fixed deposit account.

Can I Convert My Fixed Deposit into Recurring Deposit in Canara Bank?

Canara Bank Interest Rate

No, you can not convert your fixed deposit into a recurring deposit.

Canara Bank FD Rates: Check Latest updated Best FD Interest Rates, RD (Recurring Deposits) Interest Rates, Single Term Deposit Rates for General, NRI & Senior Citizens Online through Deal4loans.

Latest Updated Deposit rates News:

✓ Bank Offers 5.40 % p.a. for Canara Tax Saver Deposit scheme (General Public). Maximum deposit acceptable is Rs 1.50 Lakh.

✓ You Can Invest As low as Rs.1000/- Per Month

✓ Minimum 15 days (7-14 days – Only for single deposit of Rs.5 lakh and above), Maximum 120 months

✓ Additional interest rate of 0.50% uniformly across all maturities for Senior Citizens

✓ Loan Facility Available upto 90% of the deposit amount

Eligibility:

Individual, Joint (not more than 4), a Guardian on behalf of a minor, HUF, Partnership, a Company, Association or any other Institution

Canara Bank Fixed Deposit Interest Rates February 2021

| For Deposits less than Rs.2 Crore w.e.f. 08.02.2021 | ||

Term Deposits (All Maturities) | General Public | Senior Citizen |

| Rate of Interest (% p.a.) | Rate of Interest (% p.a.) | |

| 7 days to 45 days* | 2.95 | 2.95 |

| 46 days to 90 days | 3.90 | 3.90 |

| 91 days to 179 days | 4.00 | 4.00 |

| 180 days to less than 1 Year | 4.45 | 4.95 |

| 1 year only | 5.20 | 5.70 |

| Above 1 year to less than 2 years | 5.20 | 5.70 |

| 2 years & above to less than 3 years | 5.40 | 5.90 |

| 3 years & above to less than 5 years | 5.50 | 6.00 |

| 5 years & above to 10 Years | 5.50 | 6.00 |

Canara Bank Fixed Deposit Calculator

Compare Fixed Deposit Interest Rates

Check HDFC Bank FD Interest Rates

Latest SBI Fixed Deposit Interest Rates

Compare Ratnakar Bank Fixed Deposit Interest Rates

Get Indian Bank Fixed Deposit Interest Rates

Canara Bank Fixed Deposit Rates

Call Canara Bank Toll Free Number – 1800 425 0018