Ei Direct Deposit

Sign up or modify details for direct deposit

If you receive benefits (Employment Insurance, Canada Pension Plan or Old Age Security benefits) by cheque, or if you recently applied for benefits, you can easily sign up for direct deposit online through My Service Canada Account. Using My Service Canada Account is the most convenient way to register for direct deposit. If you already receive Social Security or SSI benefits and you have a bank account, you can sign up for Direct Deposit by: starting or changing Direct Deposit online (Social Security benefits only), or; contacting your bank, credit union or savings and loan association, or; calling Social Security toll-free at 1-800-772-1213 (TTY 1-800-325-0778. Until your direct deposit information has been updated, you will continue to be paid by cheque. If you update your direct deposit information, do not close the old account before we deposit the payment into the new account. To update your banking information, please complete a new direct deposit.

Once you choose an option, the next question or an answer will appear below.

Select your payment for direct deposit:

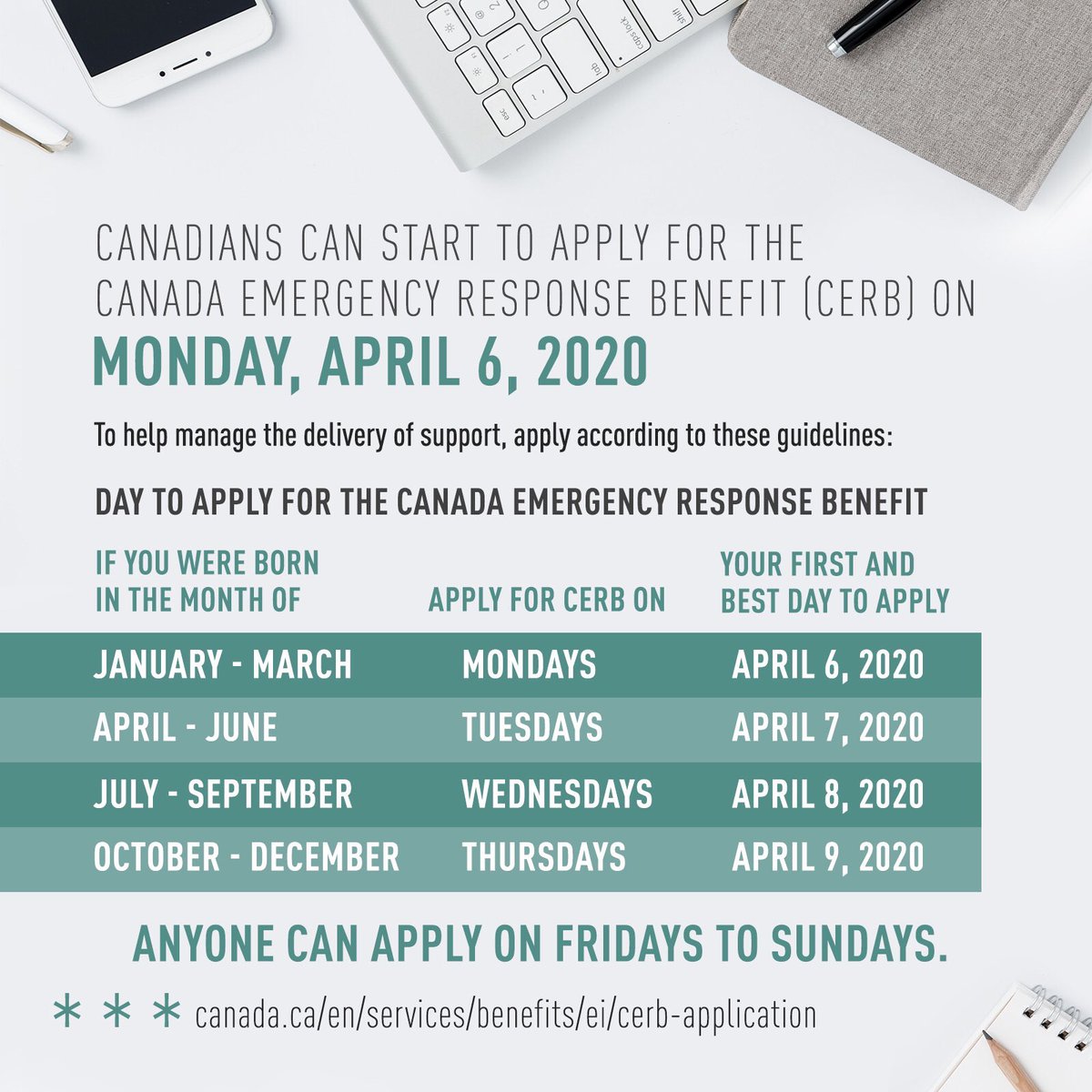

Canada Emergency Response Benefit (CERB)

Canada Emergency Wage Subsidy (CEWS)

Canada Recovery Benefit (CRB)

Details about how you can apply will be available on October 12, 2020.

Canada Recovery Caregiving Benefit (CRCB)

Information on Canada Recovery Caregiving Benefit (CRCB)Canada Recovery Sickness Benefit (CRSB)

Information on Canada Recovery Sickness Benefit (CRSB)Canada Pension Plan (CPP) or Old Age Security (OAS)

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for Canada Pension Plan or Old Age Security

- Online:

- Direct deposit with My Service Canada Account

- By phone:

- 1-800‑277‑9914

- By Teletypewriter (TTY):

- 1-800‑255‑4786

- In person:

- At your nearest Service Canada office.

- By mail (up to 3 months to process):

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Foreign

Income tax refunds or Canada workers benefit (CWB)

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for direct deposit for Canada Revenue Agency (CRA) payments

- Online:

- Direct deposit with CRA My Account (for individuals)

New

Direct deposit through participating financial institutions - By phone:

- 1-800‑959‑8281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in completing a single direct deposit enrolment form for one or several of your Government of Canada payments.

- By mail (up to 3 months to process):

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Enrolling for this payment will automatically enrol you for any other Canada Revenue Agency (CRA) payment(s) you are entitled to receive (Income tax refunds, Canada workers benefit, Canada child benefit, and GST/HST credit or provincial equivalent)

Foreign

The Canada Revenue Agency does not yet issue payments to foreign bank accounts.

If you have or can get a Canadian bank account, please use the directions above for direct deposit in Canada.

Service Canada Direct Deposit Form

Goods and services tax (GST)/Harmonized sales tax (HST) credit or provincial equivalent (example: Ontario trillium benefit, Alberta climate leadership adjustment)

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for direct deposit for Canada Revenue Agency (CRA) payments

- Online:

- Direct deposit with CRA My Account (for individuals)

New

Direct deposit through participating financial institutions - By phone:

- 1-800‑959‑8281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in completing a single direct deposit enrolment form for one or several of your Government of Canada payments.

- By mail (up to 3 months to process):

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Enrolling for this payment will automatically enrol you for any other Canada Revenue Agency (CRA) payment(s) you are entitled to receive (Income tax refunds, Canada workers benefit, Canada child benefit, and GST/HST credit or provincial equivalent)

Foreign

Direct deposit for Canada Revenue Agency from abroad

The Canada Revenue Agency does not yet issue payments to foreign bank accounts.

If you have or can get a Canadian bank account, please use the directions above for direct deposit in Canada.

Canada child benefit (CCB)

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for direct deposit for Canada Revenue Agency (CRA) payments

- Online:

- Direct deposit with CRA My Account (for individuals)

New

Direct deposit through participating financial institutions - By phone:

- 1-800‑959‑8281

- In person:

- Most banks and financial institutions in Canada will be pleased to assist you in completing a single direct deposit enrolment form for one or several of your Government of Canada payments.

- By mail (up to 3 months to process):

- Complete this Canada Direct Deposit enrolment form and send it to the Receiver General for Canada at the address indicated at the bottom of the form.

Enrolling for this payment will automatically enrol you for any other Canada Revenue Agency (CRA) payment(s) you are entitled to receive (Income tax refunds, Canada workers benefit, Canada child benefit, and GST/HST credit or provincial equivalent)

Foreign

The Canada Revenue Agency does not yet issue payments to foreign bank accounts.

If you have or can get a Canadian bank account, please use the directions above for direct deposit in Canada.

Employment Insurance (EI) benefits and leave

The government announced temporary changes to the Employment Insurance (EI) program to better support Canadians looking for work.

If you are eligible for EI benefits, you will receive a minimum taxable benefit at a rate of $500 per week, or $300 per week for extended parental benefits.

Ei Direct Deposit

If you do not become eligible for EI, you may be eligible for the proposed new benefits:

Information on Employment Insurance (EI) benefits.Veterans Allowance and Benefits

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for Veterans Allowances and Benefits

- Online:

- Veterans direct deposit online

- By mail:

- Complete this form, veterans direct deposit instructions by mail and send it to the address on the page.

Foreign

Federal public service pension plans

Please select your public service pension plan.

Federal Public Service Pension

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for the Federal Public Service Pension Plan

- By phone:

- 1-800‑561‑7930 (toll-free; Monday to Friday 8 am to 4 pm your local time)

- By email:

- pwgsc.pensioncentre-centredespensions.tpsgc@tpsgc-pwgsc.gc.ca

Foreign

Direct deposit with a foreign bank account for the Federal Public Service Pension Plan

- By phone (collect calls accepted):

- 506‑533‑5800 (Monday to Friday 8 am to 5 pm Atlantic Time)

- By mail:

- Complete the Direct deposit for individuals with a foreign bank account and send it to the address indicated within.

Royal Canadian Mounted Police (RCMP) Pension

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for an Royal Canadian Mounted Police pension plan

- By phone:

- 1-855‑502‑7090

- By email:

- pensioncentrercmp.centredespensionsgrc@tpsgc-pwgsc.gc.ca

Foreign

Direct deposit with a foreign bank account for an Royal Canadian Mounted Police pension plan

- By phone (Outside Canada and the United States):

- 1-506‑533‑5800 (Monday to Friday 8 am to 4 pm)

- By phone (From within Canada or the United States):

- 1-800‑267‑0325 (Monday to Friday 8 am to 4 pm)

- By email:

- pensioncentrercmp.centredespensionsgrc@tpsgc-pwgsc.gc.ca

- By mail:

- Complete the Direct deposit for individuals with a foreign bank account and send it to the address indicated within.

Canadian Armed Forces Pension

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for Canadian Armed Forces pension plans

- By phone:

- 1-800‑267‑0325 (Monday to Friday 8 am to 4 pm)

- By email:

- pensioncentrecaf.centredespensionsfac@tpsgc-pwgsc.gc.ca

Foreign

Direct deposit with a foreign bank account for Canadian Armed Forces pension plans

- By phone (collect calls accepted):

- 613‑946‑1093 (Monday to Friday 8 am to 4 pm EST – excluding statutory holidays)

- By email:

- pensioncentrecaf.centredespensionsfac@tpsgc-pwgsc.gc.ca

- By mail:

- Complete the Direct deposit for individuals with a foreign bank account and send it to the address indicated within.

Judges Pension

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for for judges' pension plans

- By phone:

- 1-877‑583‑4266 (Monday to Friday 8 am to 4 pm)

- By email:

- info@fja-cmf.gc.ca

Foreign

Direct deposit with a foreign bank account for judges' pension plans

- By phone:

- 613‑995‑5140

- By email:

- info@fja-cmf.gc.ca

- By mail:

- Complete the Direct deposit for individuals with a foreign bank account and send it to the address indicated within.

Federal public service pay

Direct deposit for public service pay

Current federal public servants should consult the Public Service Pay Centre for direct deposit issues related to their pay.

Start, amend or stop direct deposit of regular pay.

Canadian Government Annuities

Do you want this payment deposited into a Canadian or Foreign bank account?

Ei Direct Deposit Form

Canadian

Sign up for direct deposit or change bank information for Canadian Government Annuities

- By phone (Canada and the US):

- 1-800‑561‑7922 (Monday to Friday, 8 am to 4 pm AST)

- By phone (outside North America):

- 1-506‑548‑7972 (call collect; Monday to Friday, 8 am to 4 pm AST)

- By fax:

- 1-506‑548‑7428 (Monday to Friday, 8 am to 4 pm AST)

- By mail:

- Canadian Government Annuities Branch

Employment and Social Development Canada

P.O. Box 12,000

Bathurst NB E2A 4T6

Foreign

Student loans

Apprenticeship grants

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change banking information for apprenticeship grants

- By phone:

- 1-866‑724‑3644

- By TTY:

- 1-866‑909‑9757

Foreign

The apprenticeship grants program does not issue direct deposit payments to foreign bank accounts.

If you have or can get a Canadian bank account, please use the directions above for direct deposit in Canada.

Canada Premium Savings Bond and Canada Savings Bond

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

Sign up or change bank information for Canada Premium Savings Bonds and Canada Savings Bonds

- Online:

- Bank of Canada direct deposit online

- By mail:

- Complete this Bank of Canada direct deposit form (PDF, 806KB) and send it to the address indicated within.

Foreign

Direct deposit not available abroad

The Bank of Canada does not issue direct deposit payments to foreign bank accounts.

If you have or can get a Canadian bank account, please use the directions above for direct deposit in Canada.

Indigenous payments, grants and contributions

Are you setting up direct deposit for a business/supplier?

Yes – for a business

No – for me or another individual

Do you want this payment deposited into a Canadian or Foreign bank account?

Canadian

- By mail:

- Complete the Indigenous and Northern Affairs Canada forms and send it to the address indicated within.

Foreign

Direct deposit not available abroad

Indigenous and Northern Affairs Canada does not issue direct deposit payments to individuals with foreign bank accounts.

If you have or can get a Canadian bank account, please use the directions above for direct deposit in Canada.

Businesses and government suppliers

Other payments

You can also find the department that pays you in the departments listing.

Signing up for direct deposit – individuals

Your account information is on your personal cheques or online account. If you can't find the information, call or visit your financial institution.

You can update your account information in the following ways:

Online

- using My Account

- using MyCRA Direct Deposit

Through your Financial Institution

New options to sign up for direct deposit – Desjardins members and TD Canada Trust customers can now sign up for direct deposit through their financial institution.

Not a Desjardins member or TD Canada Trust customer? Stay tuned. Other financial institutions are expected to provide this service in the near future.

- Fill out the Direct Deposit Enrolment Form, and mail your completed copy to the address on the form.

Telephone

1-800-959-8281

Do not close your old bank account until your first payment has been deposited to your new bank account as it may already be in process or cause a possible delay.

Yes. The Canada Revenue Agency will continue to use all the account information that we have on file for you. Please log into My Account or call us at 1-800-959-8281 to tell us which account you want us to use for payments to which you may become entitled.

Call us at 1-800-959-8281 to tell us which account you want us to use for payments you currently receive by cheque.

Receiving payments

No. Although federal government agencies and departments prefer to use direct deposit for payments to Canadians, the transition discussed in the letter applies only to payments you receive from the Canada Revenue Agency.

If you don't receive your payment when expected, call the Canada Revenue Agency at 1-800-959-8281.